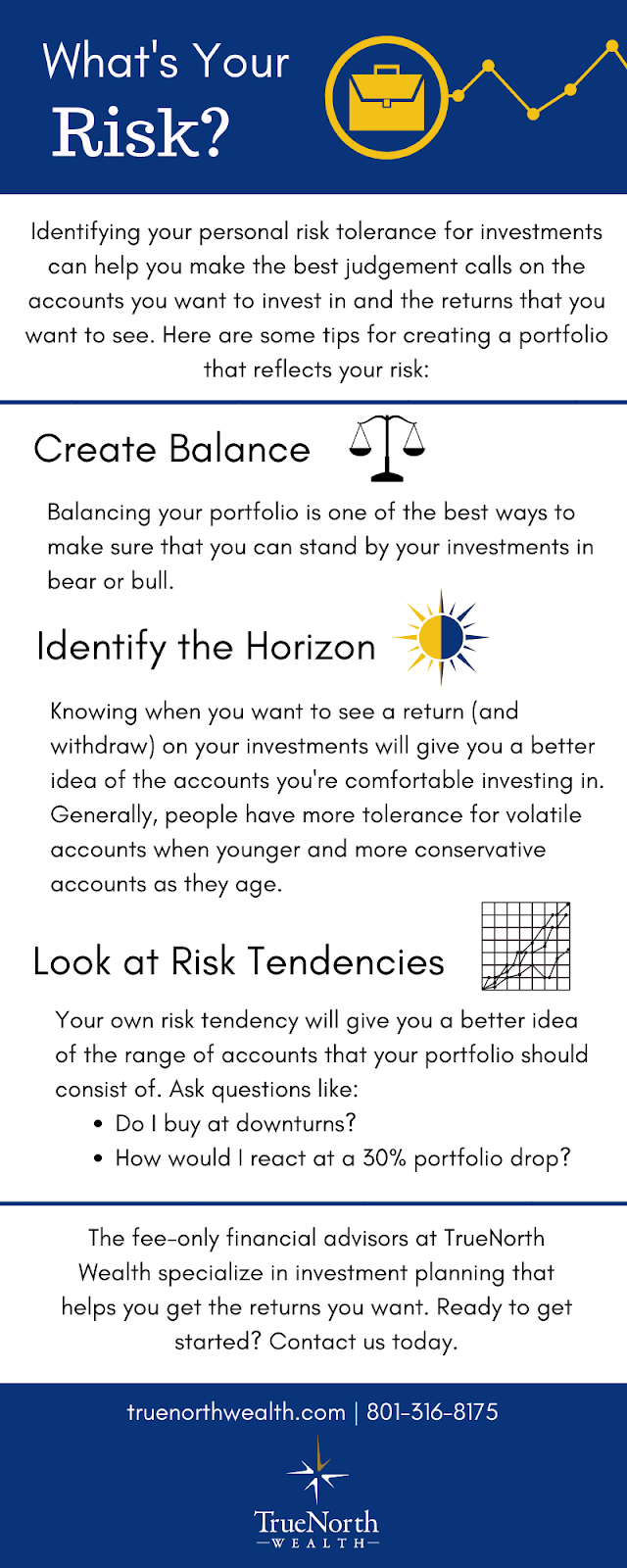

Most people do not like to hear the word “risk” anywhere near the word “finances.” Nevertheless, risk and reward are closely correlated. On average, markets reward investors who accept more risk. On the other hand, lower risk investments may yield smaller returns, but also assure smaller losses. Successful investors understand this relationship and build portfolios that reflect their personal tolerance for risk. Creating this balance in your own investment portfolio will ensure you can stand by your investments in every kind of market.

At TrueNorth Wealth, we believe there are two primary considerations when determining your risk tolerance: your investment horizon and your behavioral risk preferences.

Investment Horizon

When will you need to use the money you are investing? The longer the gap between today and your planned withdrawals (i.e., retirement), the more ability you have today to accept risk within your portfolio.

Your portfolio exists to generate cash flow to you at a future date. At that point, your portfolio will need to have more stability. But when that time is far in the future, an investor has time to weather downturns and rebalance to take advantage of that volatility. As a guideline, many of our clients who are more than ten years out from retirement utilize an 80% stock and 20% bond portfolio.

Behavioral Risk Preference

Beyond the objective portfolio management considerations, investors must consider their behavioral responses to volatility when investing. Ask yourself: how do I react emotionally in stressful situations? What would your reaction would if your portfolio dropped 30% in a short period of time? What about 50%? Do you view that downturn as a buying opportunity? Would your first response be to sell immediately, or would you be willing to ride out the bear market until things looked better? Could you continue to invest even when the market looked grim? Taking an honest look at your risk-associated behavioral tendencies is essential when creating a portfolio that you can be comfortable with in both bear and bull markets.

Consider working with a financial advisor at TrueNorth Wealth who specializes in investment planning. These experts can help you keep a level head during downward market swings, enabling you to assume a higher risk tolerance and thus a higher potential for return. A financial advisor can also aid you in discussing these topics to determine your own risk tolerance. They will assist in creating a personalized, balanced portfolio that you can stand by in any market.

To learn more, or for a no-cost consultation, contact us today.