No bull markets last forever. While, by some measures, we are in the thick of the longest bull market in history, the end always comes. So, investors must always be prepared for bear markets, both emotionally and within their portfolios.

At TrueNorth Wealth, we know that, for long-term investors with appropriate diversification and portfolio construction, bear markets can actually be quite beneficial, if handled appropriately. Consider these four ways to manage the next bear market like a pro, whenever that may be.

1. Get Perspective

It is easy to have faith in equity markets during a bull market — when stocks are soaring, and hindsight confirms your investment decisions. During these times, investors pour vast sums of money into stocks and express great hope that the upward swing will continue. When stock markets enter bear market territory (a drop of 20% or more from peak levels), investors tend to get scared and assume that the market will continue its downward trend. These emotional approaches often lead to irrational decisions that can be detrimental to an investment portfolio.

So, when the market begins a downward swing, take a step back and get proper perspective.

In the last 100 years, the average bear market has lasted about 1.3 years. Excluding 1929, it took an average of 3.3 years after a bull market’s peak for investors to completely get their money back. For a long term-investor, these time periods are short. A few years of a bear market may put a small dent in your portfolio; however, staying on strategy through the bear market can grow your portfolio leaps and bounds in years to come.

Neither bear nor bull markets will last forever. When you choose to invest your funds in the stock market, you must expect both downward and upward swings. When downward swings happen, do not panic. So long as the future vaguely resembles the past, markets will eventually turn around, and investors will be rewarded for their continued participation in markets.

2. Evaluate Your Risk Tolerance

Perhaps the most fundamental measure of investing is risk-adjusted return. All returns must be viewed in light of the risk accepted to achieve them. The appropriate amount of portfolio-level risk will vary by situation according to age, goals, and personality, but is vital for both emotional durability and to ensure that financial goals are met.

In general, the longer your time horizon until you will need to draw on your portfolio for income, the more aggressive you should be, gradually drawing down risk exposure as you approach that time horizon. Practically, this means more exposure to equity assets at first, then increasing your share of fixed-income assets, like bonds, as you approach retirement. This approach will allow you to preserve growth opportunities while you can handle the volatility but adds insulation from some of that volatility when you need more certainty.

3. Rebalance Regularly

“Buy low, sell high” is the timeless mantra of investing. Yet, too often, investors do just the opposite by chasing investments that have done well in the past and abandoning those which have not. Emotional investing will cause us to make those mistakes every time. The solution? Rebalance your portfolio regularly.

Portfolio rebalancing fundamentally sells high and buy low. Start with an appropriate allocation target for your portfolio, like 60% stocks and 40% bonds. If stocks do well relative to bonds, your allocation percentage of stocks will rise above 60%. To rebalance, you will sell the excess percentage points of stock (selling “high”) and buy back into bonds (buying “low”). So long as stocks and bonds do not move exactly the same way, rebalancing will always create a sell high, buy low effect. The same process works for any other subdivision in your portfolio.

Anytime market prices fall, it is a buying opportunity. Any time they rise, it’s a selling opportunity. Take regular advantage of these opportunities through regular rebalancing and your portfolio will become more efficient.

4. Stay on Strategy

None of the above matters if you abandon your investment strategy. In bear markets, your emotions will likely insist on fleeing whatever investments that caused your portfolio (and your psyche) so much pain. However, when heeded, these impulses typically result in a single bad outcome: selling at discounted values. So, instead of selling low, allow your portfolio to rebalance, and treat the downturn as a buying opportunity. It may seem emotionally counterintuitive, but, in the long run, it is exactly what your portfolio needs.

Nobody enjoys downward volatility in their investments, but there are ways to help manage the emotional consequences. First, be confident in your long-term investment strategy and understand the possible volatility that could emerge. Make a decision, and stick with it. There may come a time when you need to shred your investment statements unopened for a while during turbulent markets. Understand that bear markets are the worst times to change investment strategies.

A financial advisor can help you with each of these. He or she will help you develop and have confidence in your investment strategy and hold you accountable through down markets. For those who stay on strategy even during the tough times, bear markets can help them make the most of their money.

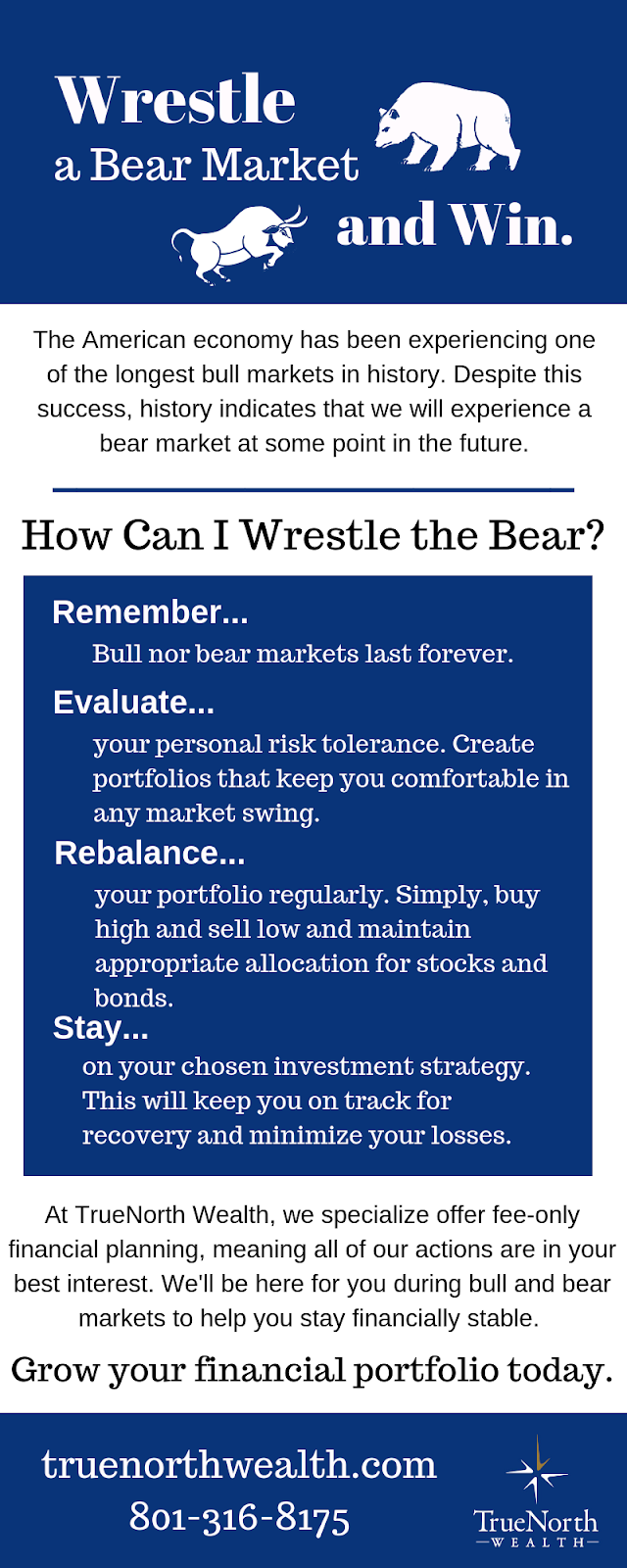

So, living through a bear market may not be comfortable or enjoyable, but if you follow these principles, you can use market volatility to your financial benefit. Here’s an infographic we made highlighting these principles in an easy-to-read fashion:

At TrueNorth Wealth, we have the knowledge and expertise to help you invest properly, no matter which direction the market is swinging. In need of financial advice? Call us at 801-316-8175.