As important as retirement planning is, it’s surprising that more people do not know how much their 401(k) savings plan costs them. In fact, according to a survey by the National Association of Retirement Plan Participants (NARPP), nearly 58% of plan participants do not know how much they’re paying in plan fees. Additionally, of the participants that did report knowing how much they’re paying, only a quarter of them know how those fees are calculated.

As plan sponsors, it’s your job to clarify these fees to your participants. By defusing the confusion around 401(k) costs and plan structure, employees may be more willing to enroll and maintain enrollment throughout their career with your company. In today’s post, we outline common points of confusion regarding cost structures with savings plans.

Clarify What Fee Costs Cover

A key point of confusion is what fee plans cover. People are willing to pay for things, they do it all the time, and retirement savings is one of the more sound expenses they’ll make in their lifetime. They just want to know what they’re paying for and why it’s important. Clarify what fee plans cover. For example, most plans include the following costs:

- Plan Administration Fees: These types of fees cover the maintenance of a savings plan including day-to-day operations, accounting, website integration and upkeep and customer service.

- Investment Fees: This second type of fee is usually a flat percentage of your account balance. It covers the investment fee portion of your account. It covers the service of mutual fund companies, from trading to buying to yearly restructuring.

So, How Much Does it Cost?

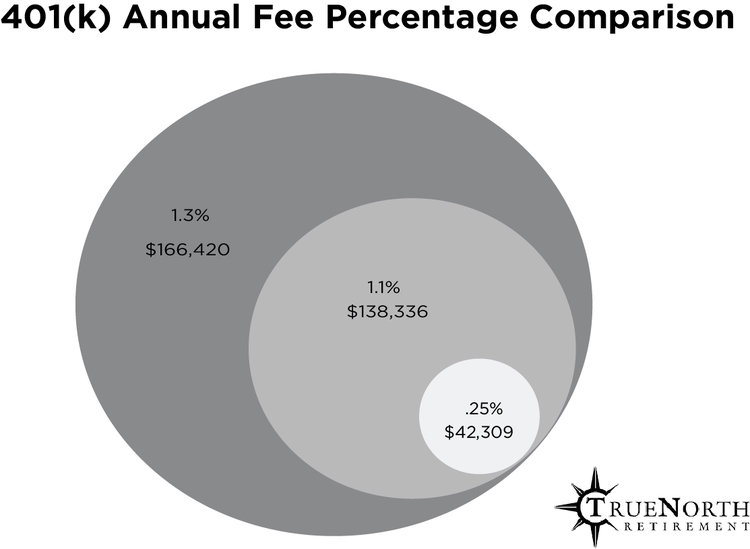

Even when plan participants understand the fee percentage, it can be challenging for them to quantify how this sum affects their bottom line. Participants hear figures between the 0.25% and 3% range. Relating these to comparison percentages with mortgage rates, for example, that are easily above 4%, these plan rates can seem fairly low. However, by quantifying these rates participants can clearly see the impact. Consider the illustration below.

If three participants all began saving at the age of 25 and all saved at the same rate of return until they were 67, using a conservative annual salary of $30,502, each participant would pay significantly different amounts based on plan fee structure. As you can see, the participant paying 1.3% will pay nearly 4 times more than the participant with a .25% structure. Those fees can drastically impact retirement savings for the employee.

What’s Industry Standard?

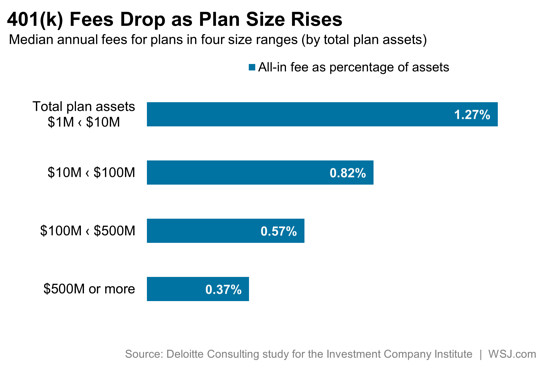

The question now is, what is the average percentage paid in plan fees every year? According to a 2014 report by consulting firm Deloitte, the average plan participant paid an estimated 0.67% in annual plan fees with a typical balance of $100,000. This translates to roughly $670 in yearly fees. For most people, this is a very reasonable expense to cover retirement services. In the following chart, Deloitte outlines the average percentage amount paid by total plan size.

Now What?

Plan sponsors, if you’re not sure what your plan fees or costs are, or if you know your current fees are to high, TrueNorth Retirement can help by providing a benchmarking service and an overview of your plan.

For more detailed information on retirement savings plans, plan sponsor options, and small business solutions, visit our website or contact your TrueNorth Retirement Services financial representative.

RECOMMENDED READING:

What Businesses Need to Know about 401(k) Plan Sponsor and Administrator Responsibilities

Successful Strategies for 401(k) Plan “Roll-ins”

Automatic Enrollment Increases 401(k) Participation in Small Plans

Should Employers Pay 401(k) Fees or Pass Them on to Employees?