Fine-Tuning Your Portfolio: How to Build a Smart Portfolio Through Factor Investing

When building wealth, having a diversified portfolio tailored to one’s goals is essential.

And with the right investments and long-term mindset, high-net-worth investors can create a portfolio to help them achieve all their financial goals and more. But to do so, they need an effective investment strategy and a clear understanding of the type of assets they should invest in.

This is where factor investing can come into play.

What Is Factor Investing?

Factor investing is an investment strategy that looks at certain factors or “aspects” that a stock or portfolio of investments may have.

By analyzing and focusing on factors like the size, price, or profitability of investments, investors hope to achieve better returns than traditional investment strategies. In addition, by tilting their portfolio towards factors that have outperformed the broad market historically, investors may be able to better manage risks and get better returns for the amount of risk they take on rather than just investing broadly across the stock market.

How Is Factor Investing Different Than Index Investing?

Factor and index investing are popular investment strategies that differ in their approach to building a portfolio.

Index investing involves investing in a market index to achieve broad market exposure, while factor investing seeks to identify specific characteristics, such as value or size, and tilt or shift more of the fund toward securities that exhibit those characteristics. While index investing can be a lower-cost way to achieve market returns, factor investing has a growing body of research to suggest that it can outperform broad market indices over the long term. Moreover, by strategically selecting securities based on specific factors, factor investing may offer higher returns.

Dimensional Fund Advisors (DFA) is an example of a firm that uses factor investing strategies.

By combining rigorous research with deep insights into capital markets, DFA provides investors with the tools they need to make informed investment decisions and build better portfolios. They offer a range of solutions for high-net-worth investors through their partnership with financial professionals, including factor investing portfolios tailored to their individual needs and goals.

With DFA’s factor investing strategy, investors can access various asset classes with different risk profiles and expected returns. This gives them the flexibility to create diversified portfolios tilted toward certain factors, which can help them reduce risk and increase potential returns.

What Are The Factors To Consider?

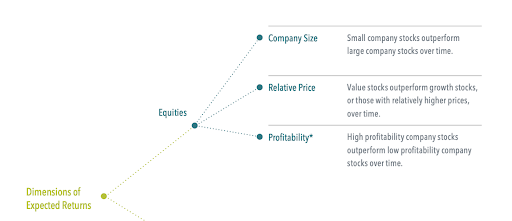

There are many factors you can use to create a factor portfolio, but here are three key factors to consider.

Photo Credit: Dimensional Fund Advisors

Company Size (Small)

The company size factor represents an investing approach that focuses on the market capitalization of a company.

In contrast to large-cap stocks, small-cap stocks are generally considered to be more volatile but have greater potential for growth.

The market cap for large-cap stocks typically ranges from $10 billion or higher, while medium-cap stocks can range between $2 billion to $10 billion, and small-cap stocks typically have a market cap of less than $2 billion. However, these ranges can vary depending on the specific classification used by different financial firms or indices.

Generally, small-cap stocks can be expected to outperform large-cap stocks over large periods. So, many investors using a factor approach decide to tilt their portfolios more toward small caps, adding some additional risk in exchange for higher potential returns.

Relative Price (Value)

The value factor represents stocks that are priced lower relative to their fundamental value.

These stocks are often in mature or out-of-favor industries, causing them to be undervalued by investors. Value investing differs from growth investing, which focuses on stocks that are expected to grow revenues and earnings at a faster rate than the overall market. Investing in value stocks can provide investors with higher returns than other options because they have the potential to rise in value as the market recognizes their true worth.

Investors look for companies with solid financials and low valuations to identify value investment opportunities, such as low price-to-earnings (P/E) ratios. Risks include the possibility that undervalued stocks may not appreciate as much as anticipated.

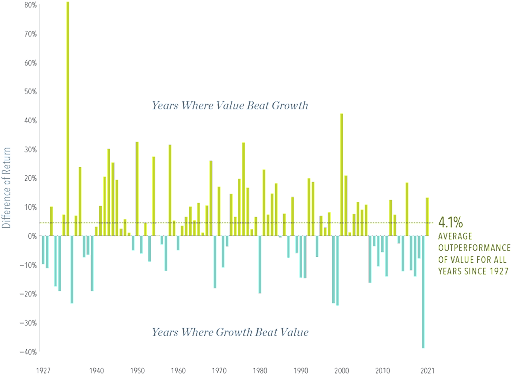

Using this chart from DFA, we can see why investors choose to tilt towards value over growth, as value has outperformed growth by an average of 4.1% for all years since 1927.

Photo Credit: Dimensional Fund Advisors

Profitability (High)

Investors often consider the profitability of a company when deciding whether to invest in a particular stock.

Profitability measures a company’s ability to generate earnings relative to its expenses and can indicate future growth potential. High profitability can signal that a company has a competitive advantage and can be expected to generate strong returns over time. Conversely, low profitability can be a red flag and may indicate that a company struggles to generate sufficient earnings to cover its expenses.

It’s important for investors to analyze a company’s current and historical profitability in context with its industry and competitors. By doing so, investors can make informed decisions and potentially earn higher returns.

One important thing to consider with factor investing is that while many of these factors have been shown to outperform over long periods, they can still have periods of underperformance. The best way to think about this is to imagine you have a coin, heads, and tails that is more weighted towards heads. Over long periods, you know your weighted coin should be 70% heads and 30% tails, but you also know that in the short run, you can have a series of tails in a row, purely based on chance.

So factor investing can work well over long periods, but it can take time and patience in the short run.

What Are The Benefits of Factor Investing?

Factor-based investing can help investors achieve their wealth goals by providing a systematic approach to constructing and managing a portfolio.

By selecting stocks according to specific factors such as price, size, and profitability, investors are able to take advantage of market inefficiencies and potentially outperform the overall market. Not only does factor-based investing offer the potential to access higher returns, but it can also help investors better manage risk. Furthermore, factor-based investing can be more cost-efficient than other actively managed approaches, creating less cost or fee drag on the investor’s portfolio.

By combining historical data with quantitative analysis techniques, investors can identify companies that have the potential to generate higher returns over the long run.

In the end, building a portfolio that is tailored to one’s goals can be a complicated and time-consuming process, but it can also be well worth the effort.

Fortunately, you don’t have to do it alone.

TrueNorth Wealth is here to help.

If you’re interested in working with a fiduciary CFP® professional to help outline your unique investment plan, complete with a custom investment portfolio to deliver your financial goals, then TrueNorth Wealth is here to help.

TrueNorth Wealth is among the top Wealth Management firms in Utah and Idaho, with offices in Salt Lake City, Logan, St. George, and Boise. At TrueNorth Wealth, we focus on helping our clients build long-term wealth while maximizing the enjoyment they receive from their money. We do this by pairing our clients with a dedicated CFP® professional backed by an incredible team.

For our team at TrueNorth, it’s about so much more than money. It’s about serving families all across Utah and helping them achieve freedom and flexibility in their lives. To learn more or schedule a no-cost consultation, visit our website at TrueNorth Wealth or call (801) 316-1875.