One of the more difficult issues that comes up during a divorce is how to divide assets, benefits and debts. Your state of residence might have an answer for you if you live in one of the nine community property states. Otherwise, decisions about the division of property can be determined in mediation, by your lawyers, or in court. Additionally, if you and your spouse signed a prenuptial or postnuptial agreement, that can affect who gets what.

Assets and Debts

Community Property States

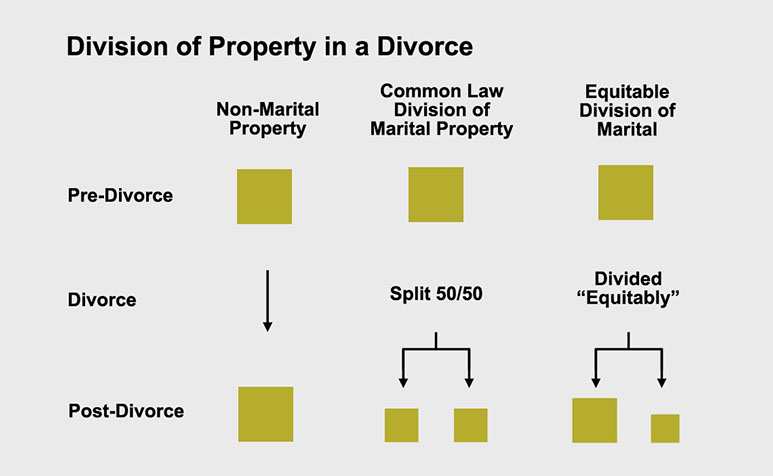

If you live in a community property state (Wisconsin, Louisiana, Texas, California, Arizona, Idaho, Nevada, New Mexico, and Washington) and don’t have a pre- or postnuptial agreement, your assets and debts will likely be split right down the middle, 50 percent to you and 50 percent to your spouse. Regardless of who purchased the asset or acquired the debt or how it is titled, each spouse has an equal interest. This division only applies to marital property—anything acquired during the marriage other than gifts and inheritances. Property and debts acquired prior to marriage are considered separate property, and are not divided 50/50.

Equitable Division of Property States

The division of assets and debts is more complicated if you live in one of the other 41 states, called equitable division of property states. Divorcing couples who live in an equitable division of property state have some work to do in deciding who gets what. Assets and debts are designated marital property or separate property in the same way as in a community property state, but it does not have to be split 50/50. Each spouse is awarded a percentage of the assets and debts, called equitable distribution. The court decides what is fair and reasonable based on how long the marriage lasted, what each spouse brought to the marriage and what they each earn, among other factors.

Some Facts about Dividing Assets and Debt

You and your spouse can work together with lawyers and financial planners to achieve the greatest benefits for both parties. For instance, you can pay off debts before the divorce is final, postpone the sale of your home or other assets, or make tax-free investment asset transfers to your spouse.

Whether you’re in a community property state or not, if you’ve combined credit accounts with your spouse, both parties’ credit scores are on the line for all debts, even if your divorce decree states that one party is responsible for paying them off.

If you and your spouse are unable to agree to a settlement on the division of your assets and debts, you’ll be at the mercy of the court’s decision.

After negotiations are complete and the court signs your divorce decree, the decisions are final.

Who Keeps the House?

Your home is probably the largest asset between you and your spouse. A divorcing couple must decide which spouse gets to keep the house or whether or not to sell it. Many couples decide to sell, either because neither spouse can afford to own a home on their own or because they don’t own enough other assets to offset the value of the house’s equity.

Another option is to agree to postpone the sale of the house until a specified future date. This can be done either to provide stability for any children currently living in the house or to avoid a poor housing market. Once the house is sold, both spouses split the equity.

Keep in mind that if you sell the house, you’ll have to decide together the selling price, broker, showings and other details involved in selling a home. Similarly, if one of you keeps the house, there will be paperwork and fees to contend with in order to transfer ownership of the house.

Benefits

Just like your other assets, your retirement plans are considered marital property and are subject to equitable division in the case of a divorce.

Defined Benefit Plans

A defined benefit plan is funded by your employer; you don’t typically contribute part of your paycheck to this type of retirement plan. If you and your spouse decide to divide your pension benefit during divorce, you’ll first have to determine what it’s worth. This can be tricky with a defined benefit plan, so the court will require you to have an actuary determine the value of this asset. This is especially necessary if one spouse chooses to waive access to the other’s pension in favor of an equal value asset.

Defined Contribution Plans

The difference between a defined contribution plan—such as a 401(k)—and a defined benefit plan, is that a portion of your paycheck funds the 401(k). Determining the value of a defined contribution plan is simpler than for a defined benefit plan, because the account holder should be receiving regular statements concerning the plan’s value. Dividing a defined contribution plan is also simpler than dividing a defined benefit plan: a one-time distribution from one spouse’s defined contribution plan into the other’s IRA can be done tax-free and without the early distribution penalty.

To transfer benefits from a retirement plan (whether it’s a defined benefit or a defined contribution plan) to your spouse, you’ll need to obtain a Qualified Domestic Relations Order (QDRO). Retirement plans are governed by federal law, so unlike other assets, the state cannot alone dictate their equitable division. Your QDRO must be approved by both your plan administrator issuing the benefits and the court. Without a QDRO, distributions to your ex-spouse will be taxed to you and subject to early distribution penalties (10 percent if you’re under 59 ½ years old).

Social Security

If your spouse has contributed to the social security system, you may be entitled to receive half of his or her social security benefits after you divorce. You are eligible if:

- Your spouse is eligible

- You were married for at least 10 years

- You have been divorced for at least two years

- You have not remarried (unless your second marriage occurs after you turn 60 years old)

- You are at least 62 years old

- Your own social security benefits would be less than your spouse’s

Note that your eligibility and receipt of your ex-spouse’s social security benefits has no effect on the amount he or she is eligible to receive.

Health Insurance

If your company provides coverage for your spouse and employs at least 20 employees, they are obligated to inform your spouse about the option to receive continued coverage for 36 months post-divorce, under the federal Consolidated Omnibus Budget Reform Act (COBRA). Your spouse must enroll in COBRA within 60 days of the divorce becoming finalized, or else he or she waives access to continued coverage. Your spouse will continue receiving the same health insurance coverage as he or she did prior to divorce, but the premiums may increase by up to 102 percent at the discretion of your employer. It may be more beneficial for your spouse to seek health insurance elsewhere, depending on the cost.

A financial advisor can help you and your spouse navigate these decisions throughout your divorce negotiations. The stipulations seem complicated to many couples, and a professional can make sure that both parties are provided for as they embark on their separate lives.