According to recent statistics by the U.S. Census Bureau, in 2014 the average American household brought in on average nearly $73,300 per year. This number is sharply contrasted by the median household income of $53,719 reported in the same year. These numbers tell us that while the average income level of all Americans is increasing, the median is not; which means there are a small percentage of high-income households who are skewing the average to be above the median.

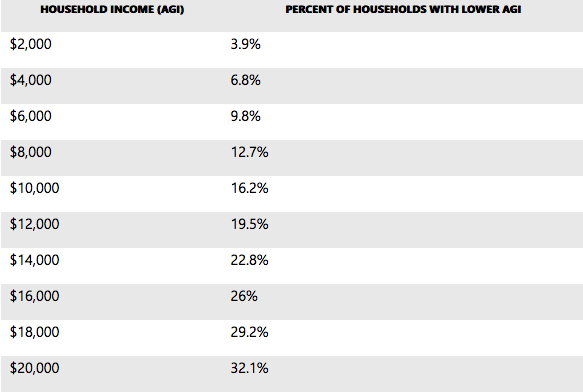

An important measure used by the IRS to determine taxable income is Adjusted Gross Income (AGI). Adding together all income and subtracting qualified deductions calculate this measure. The chart below, referenced from an MSN article, highlights AGI for American households in 2014. As you’ll see the median AGI falls into the $50,000 range discussed earlier. At the $100,000 earnings mark, nearly 84% of all Americans make less than this figure. And, at the $200,000 mark, 95.5% of all Americans make less than this figure.

These findings will come as no surprise to most, as the issue with wage inequality in the United States is a prominent topic today. However, despite varying income levels, which are largely impacted by factors like where you live and your household makeup, it is possible for earners at all income levels to save significant amounts of money for retirement. Utilizing investment tools provided by TrueNorth Wealth advisors, we lay out a strategy to save your first million on an average U.S. Income.

How Much are We Saving? A Look at Average U.S. Savings

Turning to savings, our savings rates in America are dismal. A 2015 report by Market Watch found that average American households have less than $1,000 in savings, and over 20% do not have a savings account. This information signals that large portions of Americans are living paycheck-to-paycheck. Continuing this trend will mean a large number of Americans will not be prepared for retirement.

The questions of how much income one will need during retirement is largely dependent on inflation rates, the future economic landscape, health, and lifestyle of the individual. A U.S. News Report estimates that a person will need roughly 70-80% of their preretirement income each year to sustain their current lifestyle. A large unknown is how healthcare costs will affect someone at retirement age, when the majority of people will require more frequent care.

Building wealth is easier when earnings are higher. This fact is undeniable. It’s difficult to save money until basic needs like housing, food, and bills are covered. However, the important factor in building wealth is not what amount of money you bring in, but what you do with that income. It’s vital to begin the savings process now. One of the most effective tools to make savings work for you is the idea of compound interest and the effect of time on savings. Compound interest is the interest earned on principal investments combined with previous interest earned. By investing early, principal amounts can grow significantly.

Make Your Paycheck Work For You: Path to Saving Your First Million

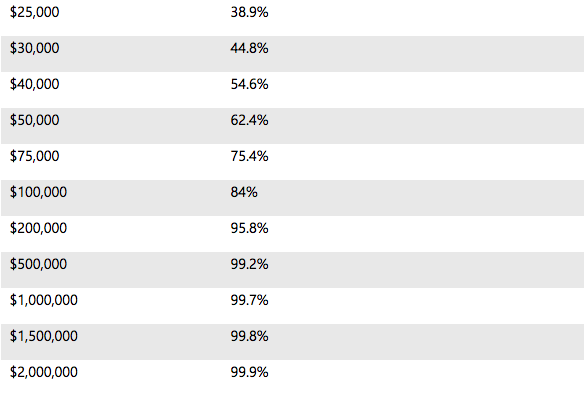

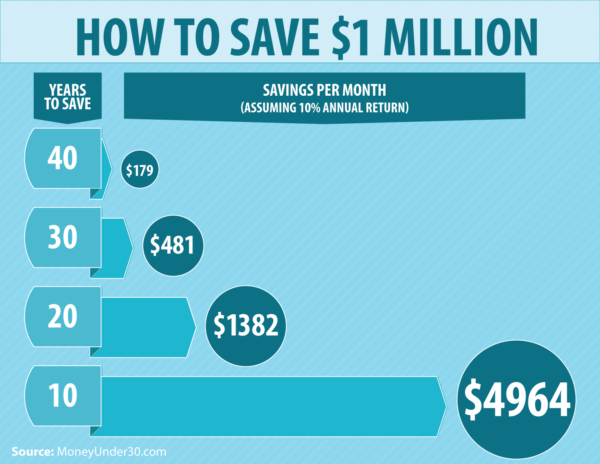

For example, how much money should you be saving each month to reach your first million? The answer will vary by person, but a general guideline can be formed depending on the amount of time you have until retirement. As with the idea of compounding interest and the power of time, the earlier you begin saving for your first million, the better. Most people aim to retire at the age of 65. The benefit of starting to save for retirement at age 30 is significant compared to those that start just ten years later at age 40.

If you begin saving in your 20’s:

For those that begin saving in their 20’s, you give yourself a significant advantage in reaching $1 Million in retirement savings. With 40+ years to wait before retirement, granted a 10% rate of return, you need to save just $179 a month to retire a millionaire. At 6% rate of return, you’d need to save $522 per month.

If you begin saving in your 30’s:

For those that begin saving in their 30’s, they typically have around 30 years to let their contributions grow for retirement. Waiting 10 years later than someone investing in their 20’s means you’ll need to contribute more monthly to make up for the time. With a rate of return of 10%, you’ll need to save $481/month. At 6% you’ll need to save $1,021 monthly.

If you begin saving in your 40’s:

For those that begin saving in their 40’s a significantly larger portion of his or her paycheck must be put into savings to reach $1 Million by age 65. With approximately 20 years before retirement, you’ll need to save $1,382 monthly at 10% rate of return, and $2,195 monthly at a 6% rate of return. You can see the significant difference in savings at this timeframe.

If you begin saving in your 50’s:

Saving a little is better than not saving at all. If you don’t begin saving until your 50’s, you are at a disadvantage to reaching your desired $1 Million in retirement, but it’s not impossible. At 10 percent rate of return, you’ll need to save $4,964 monthly. At a 6% rate of return that number jumps up into the $6,000 level. These are fairly difficult levels to save each month. We advise starting to save for your retirement as soon as possible.

The chart below highlights these savings amounts by years to save:

How Can You Start Saving More Today?

At TrueNorth Wealth our goal is to create financial strategies for our clients to be secure in their futures. There are several steps one can take to build wealth and there is not a single one-size-fits-all strategy that will work for everyone, as each person’s needs, goals, and expectations are different. However, there are general guideline steps to consider. We’ve outlined a general tool guide below.

- Live within your means. Yes, it may be tempting to buy a new car every year or to upgrade to your dream house. However, it’s vitally important to live comfortably within your means i.e. with the income you generate after savings. Your priority should be to save money and maximize your financial investments. The remaining income should be used to cover needs, and then finally wants.

- Take advantage of financial strategies. Maximize the contributions for 401(k), IRA, and other savings plans. If your employer provides matching of contributions, maximize the percentage. Pay yourself first with your paycheck through savings. At TrueNorth Wealth we specialize in having the expertise to advise clients on the best tools to maximize wealth. From creating life insurance plans, to utilizing tax break strategies, to investing in bonds and mutual funds. Examples of areas where our financial advisors can provide beneficial financial strategies include:

- Ensuring prudent decisions with pre and post-tax dollars

- Important details and advice related to your social security strategy

- Identifying retirement goals and tracking progress

- Decreasing your tax burden to save you money

- Creating strategies to ensure you have the income you desire for a comfortable retirement

- Reviewing your insurance plan(s) to make certain the plans provide adequate coverage without unnecessary or excessive coverage

- Evaluating your estate plan

- Track Spending Meticulously. You should know where every penny of your income is spent. By tracking where your money goes, you can cut back on unnecessary purchases. Those frequent Starbucks runs can cost you thousands each year.

- Pay off your debts. Before you can build wealth, you need to be debt free or close to it. Pay off all credit cards, get rid of student loans, pay off cars (try to avoid buying a new one if your old one is paid off and still works). The exception to this rule may be your mortgage. Most people aren’t able to pay off their mortgages easily. Work towards paying an additional amount each month to the principal loan amount. Doing this can save thousands of dollars over the course of the loan.

- Generate additional income. Work to create additional revenue streams through part-time businesses or by offering valuable services. There are many ways to generate additional income each year that can allow for added opportunities to reach financial goals.

TrueNorth Wealth is a financial and wealth management firm based in Salt Lake City specializing in personalized financial guidance to individuals and businesses. Contact our Salt Lake City office today to discuss a more rapid wealth growth path for you.

Related Reading:

Fiduciary: The Most Important Financial Term You’ve (Likely) Never Heard Of

4 Financial Planning Considerations Before Getting Married

4 Things to Know About “Robo-Advisers”

Choosing a Financial Advisor: The Questions You Need to Ask

4 Financial Questions for Engaged Couples

Sources:

- MSN: http://www.msn.com/en-us/money/personalfinance/heres-the-average-american-household-income-how-do-you-compare/ar-AAjBl7O?li=BBnb7Kz&ocid=iehp

- Market Watch: http://www.marketwatch.com/story/most-americans-have-less-than-1000-in-savings-2015-10-06

- U.S. News: http://money.usnews.com/money/blogs/on-retirement/2014/08/19/how-much-money-do-you-need-to-retire

- Windgate Wealth Management: http://windgatewealthmanagement.com/the-power-of-compound-interest-and-why-it-pays-to-start-saving-now/

- Yahoo Finance: https://www.google.co.uk/search?q=how+much+do+people+spend+at+Starbucks+a+year&ie=utf-8&oe=utf-8&gws_rd=cr&ei=WDorWPb4E6idgAa_7oGwCA

- MoneyUnder30: http://www.moneyunder30.com/save-one-million-dollars