Taxes can be complex and scary, but they are also one of the most impactful areas of financial planning.

That’s because, unlike other areas of planning like insurance, investments, or estate planning, tax planning typically has an immediate and tangible benefit—you save money in taxes and benefit from those savings immediately. And, for high-net-worth families and individuals, taxes can represent a significant part of their annual expenses.

So, with the tax filing deadline behind us, it can be a great time to review your return and understand a few key measures and figures.

This checklist is designed to help you review your tax returns, so grab your calculator, a copy of your tax return, and let’s review.

1. First, Let’s Calculate Your Marginal Tax Rate.

Your marginal tax rate is the tax you pay on an additional dollar of income.

First, look at the top of your tax return and find “filing status.” Next, identify which box is checked (single, married filing jointly, married filing separately, head of household, or qualifying surviving spouse.) This is critical as it will determine which tax brackets apply to your situation.

![]()

Next, find line 15. This is your taxable income.

![]()

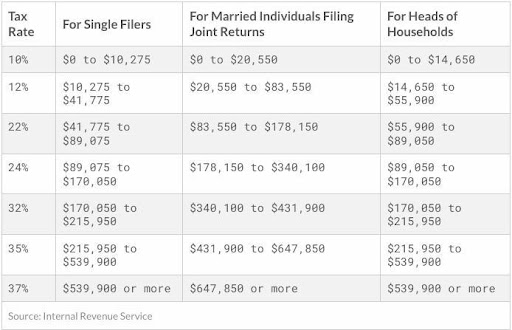

Then, using your filing status and taxable income, find your marginal tax bracket using the image below.

Start by using your filing status to select the appropriate column at the top, then find which bracket your taxable income lands in.

2022 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households

Photo Credit: The Tax Foundation

For example, if your filing status is married filing jointly, and your taxable income is $395,000, you can see that your taxable income falls in the 32% tax bracket since it is between $340,100 and $431,900. This means that your marginal tax rate for 2022 was 32%, and any additional income that year would have been taxed at 32% until your taxable income went over $431,900.

But, one common misconception is that your marginal rate applies to all your income. That’s not the case, and only a portion of your income for 2022 was taxed at 32%, using the example above.

What actually happens is that your income flows through each tax bracket, filling them up one by one as it goes. So some of your income is taxed at 10%, some at 12%, and so on, all the way to the 32% bracket.

So what does this mean?

By identifying your marginal tax rate, you can determine how much you would pay in taxes for each additional dollar of income and, more importantly, how much you stand to save in taxes with each deduction.

For example, if you are a high-earner that is in the 32% tax bracket and trying to decide whether to contribute to a Traditional 401(k) or a Roth 401(k), you’ll realize that Traditional may be a better option because you can save .32 for every $1 of contributions. So, if you’re over 50 and contribute $30,000 to your 401(k) in 2023 (including catch-up contributions), you would save $9,600 in taxes, assuming all of that income would have been taxable at the 32% bracket.

By calculating your marginal rate, you now have a quick understanding of how much you are paying in taxes for each additional dollar and, again, how much you stand to save with each deduction.

2. Second, Let’s Calculate Your Effective Tax Rate.

Your effective tax rate is the percentage of your taxable income that you paid in taxes for the year.

When most people think of “how much they paid in taxes,” what they are really thinking of is their “effective tax rate.” In other words, they want to know the blended or average percentage they paid after accounting for all the different amounts of income in each tax bracket.

Here’s how you can calculate your effective tax rate.

First, find line 24 on your Form 1040. This is your total tax.

![]()

Then, take the amount from line 24, and divide it by the amount on line 15, your taxable income.

Multiply the result by 100, and you have your effective tax rate as a percentage.

Here’s an example using the same numbers from above ($395,000 of taxable income and married filing jointly):

- Line 24 (Total Tax) = $88,433

- Line 15 (Taxable Income) = $395,000

- Effective Tax Rate = $88,433 / $395,000 = .2239 X 100 = 22.39%

This means that based on your total taxable income, and the total amount of tax you paid, your average or ‘effective’ rate you paid was roughly 22% in taxes for every dollar of earnings.

So, while your highest marginal rate was 32%, your effective rate was much lower, at 22.39%.

3. Lastly, Look At Your Capital Gain Or (Loss).

Lastly, look for line 7, Capital Gain or Loss.

![]()

If you see -$3,000 on line 7, congratulations, you received a $3,000 deduction from your taxable income. If you’re in the 37% tax bracket, that means you saved $1,110 in taxes ($3,000 X .37 = $1,110).

But, if you see a positive amount in that box, it may be worth investigating for future years.

Generally, if you aim to be tax efficient with your investments, you want to limit the amount of capital gains you report each year. Of course, different situations will require different planning, and in some years, you may be unable to avoid a significant capital gain. Still, generally, you want to try and limit taxable gains and take advantage of capital losses whenever possible.

One way to take advantage of capital losses is through tax-loss harvesting. Tax-loss harvesting is a strategy where you sell investments that have declined in value to offset capital gains taxes. By doing this, you can reduce your overall tax bill while still maintaining a diversified investment portfolio. However, it’s important to be mindful of the wash sale rule, which prohibits you from buying back the same or a substantially similar investment within 30 days (before or after the sale) to claim the tax loss.

If none of that made sense, don’t worry, but this is where it could be wise to consult with a qualified financial professional who can help you understand all the tax strategies you have available while being as tax efficient as possible with your investments.

TrueNorth Wealth is here to help.

If you want to work with a fiduciary CFP® professional to help you master your taxes, complete with a custom investment portfolio to deliver your financial goals, then TrueNorth Wealth is here to help.

TrueNorth Wealth is among the top Wealth Management firms in Utah and Idaho, with offices in Salt Lake City, Logan, St. George, and Boise. At TrueNorth Wealth, we focus on helping our clients build long-term wealth while maximizing the enjoyment they receive from their money. We do this by pairing our clients with a dedicated CFP® professional backed by an incredible team.

For our team at TrueNorth, it’s about so much more than money. It’s about serving families all across Utah and helping them achieve freedom and flexibility in their lives. To learn more or schedule a no-cost consultation, visit our website at TrueNorth Wealth or call (801) 316-1875.