There are several vehicles available for investors to use to save money. One of the most straight-forward options is the certificate of deposit. These low-risk options are ideal for investors who want to utilize the benefits of compound interest while keeping assets fairly liquid. They’re also a great tool to introduce new or young investors to the benefits of saving.

What is a Certificate of Deposit?

Before diving into how a certificate of deposit works, let’s start from the beginning: what is a certificate of deposit? Investopedia provides a great summary of the tool saying, “A certificate of deposit is a promissory note issued by a bank. It is a time deposit that restricts holders from withdrawing funds on demand.” Think of a Certificate of Deposit like a step up from a traditional savings account. Both are issued by banks and credit unions, and are thus backed by these institutions; making CD’s virtually risk-free. In essence, opening a CD is like giving your bank or credit union a loan. You provide the principal amount for a given period of time in exchange for principal plus earned interest.

Certificate of deposits vary in their interest amount by three factors: 1. Initial principal investment, time period or maturity date, and interest rate. As you might expect, the larger the principal amount and the longer a life of a CD, the higher the fixed interest rate will be. Alternately, the less amount saved and the shorter time period will result in lower interest rate returns. Banks and credit unions offer customers set CD options; customers can often select from CD plans that best fit their given investment goals.

Determining the Right CD for You

There are two primary factors in determining which Certificate of deposit is ideal for your situation. Firstly, it’s important to understand your time horizon. How long are you able to keep a cash reserve in a CD? When will you need the money? And, what other possibilities for earning could your cash reserve be used for? If you will not need the cash reserve for at least 6 months, a CD may be a great option for you. A CD is particularly useful in providing a platform for relatively short-term savings. For example, if you’re saving for a downpayment for a home, using a CD to accumulate savings may be a great option. However, CD’s may not be the most effective way to generate the most amount in savings. Tools like retirement savings plans – (401)k’s, IRA’s, and money markets – may be more effective in producing savings returns over longer periods of time.

The second consideration for a CD is the rate of interest. What amount of income will you generate by using a CD? The amount will be your principal repayment amount plus accrued interest amounts. For example, if you invest $10,000 in a 1 year CD that earns at a 3% annual interest rate you’ll earn $300 in interest annually. During times of inflation, when interest rates are rising, short-term CD’s may be best as to not tie-up income in lengthy CD’s that could be earning less than current market rates. If rates are falling, like during a recessive economy, longer CD’s usually make sense to keep invested money locked in at advantageous rates.

Current Rates

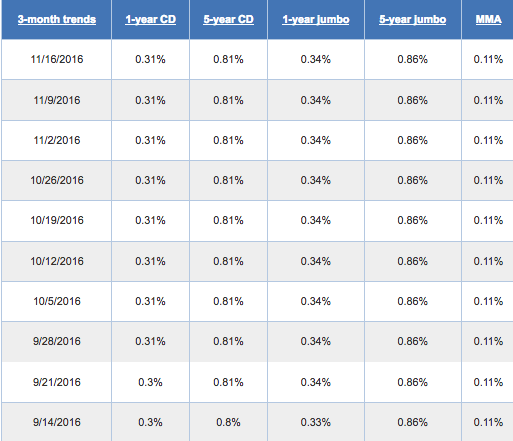

A critical factor in determining whether a CD is the best tool for your investment is to look at the current CD rates. On average, today’s rates are significantly lower than their peak in the 1980’s. Today, earning even a 1% rate of return would be considered a high rate of return. Most current CD rates hover between lows of 0.30% to highs of 0.80%. Current rates are shown below.

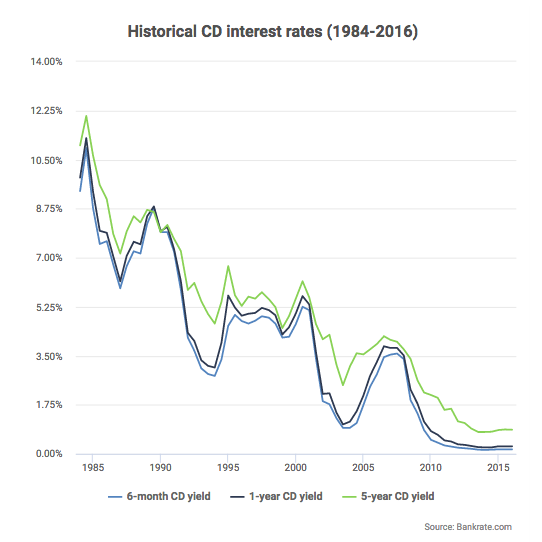

The chart below from BankRate shows historical CD interest rates from 1984-2016. As you can see CD’s as a vehicle investment tool were much more effective in the late 80’s and 90’s. In today’s current financial environment, CD’s are less effective. However, the unique attributes of CD’s still provide useful to some investor situations.

Consider a Ladder Approach

One way to make CD’s an even more effective tool is to use a “ladder” approach in terms of investing. Doing this will break a lump sum investment into several smaller investments and investing each one into a different CD term. For example, one CD might be opened with $5,000 in a 1-year CD with 0.31% annual interest, a second CD might be opened using $10,000 in a 3-year CD with 0.75% annual interest, and a third CD might be opened with $20,000 in a 5-year CD with 0.86% interest. By staggering or creating a “ladder” effect with investments, you’re able to generate larger rates of returns while still keeping assets fairly liquid. When the first CD matures, that money is now available for use or can be reinvested. Remember, CD’s can vary in size from “small CD’s” generally savings under $100,000 to jumbo or large CD’s over $100,000. Rates of return will vary greatly depending on principal amount invested.

For more information on certificate of deposits and creating a specific financial strategy that fits with your personal financial goals, visit our website or contact our certified financial planners at TrueNorth Wealth.

Related Reading:

Looking for Someone to “Beat the Market?” Good Luck.

The Do’s and Don’ts of IRA Investing

What is the Difference Between a Stock and a Bond?